discounting, where a taxpayer remains in charge of their credit control.These two options are called recourse and non-resource factoring.įactoring is just one subcategory of invoice finance.

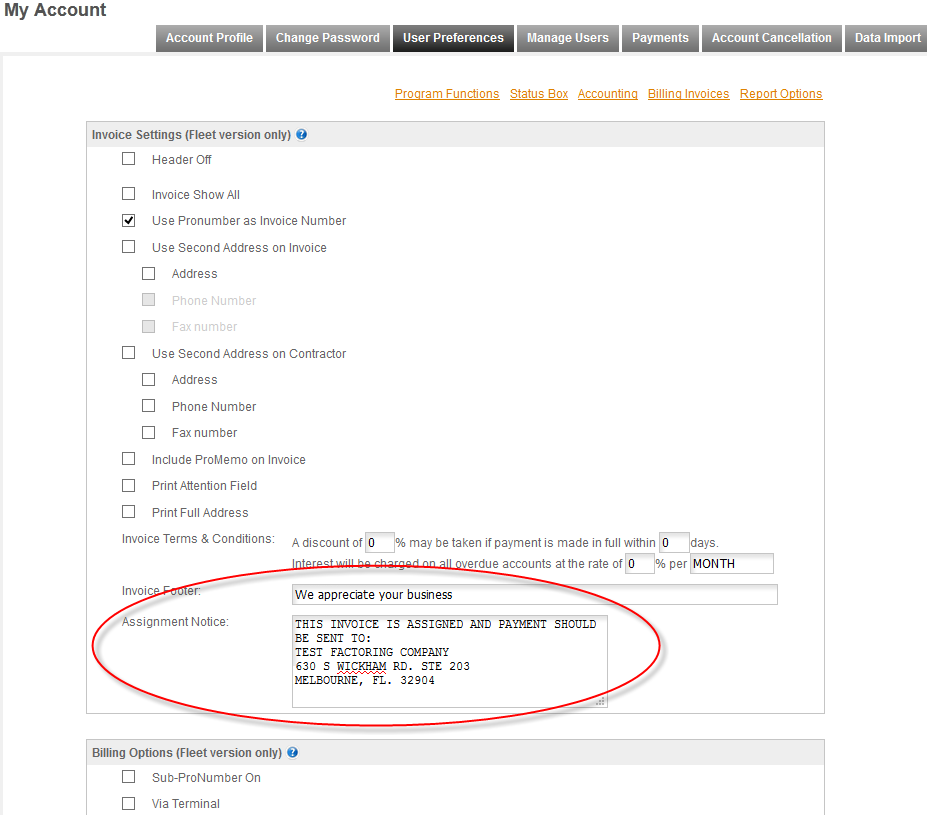

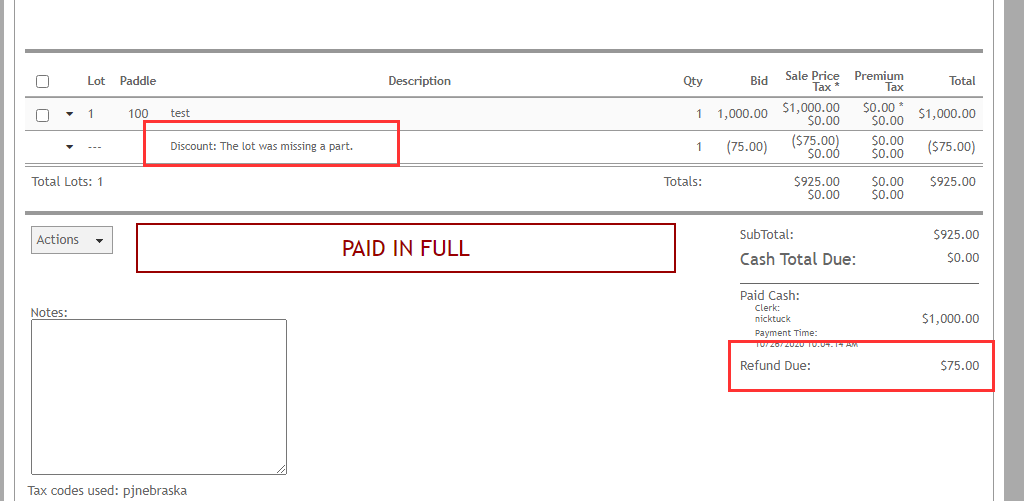

That way, it’s possible to minimize the exposure to bad debts. Some factoring providers guarantee an option to credit insure a specific customer or an entire sales ledger. The customer company will be aware that you are using factoring. Usually, payment company’s customers are supposed to go to the bank account controlled by a debt factoring company. It could be limited by certain terms, such as constraining exposure to a single large client. The amount of financial reimbursement available will typically be stated as a percentage of the company’s outstanding debtor book or sales ledger. A factoring provider lends against the company’s customer invoices, allowing it to gain most of the invoice cash right away rather than waiting weeks or even months to get paid. Invoice factoring (or debt factoring, invoice finance, asset-based lending) is a form of finance created for companies invoicing their customers and getting payment on specific terms. Keep reading the article to learn more about invoice factoring and how it works. The business or independent contractor receives cash according to the invoice. But what to do when low on cash flow and clients take 30 or more days to pay for a job performed a while ago?

#Invoice factoring riverside plus#

Typically, traditional bank loans have too high interest, plus it means that a company will be in debt. Luckily, the modern world has a simple and useful solution called invoice factoring. Typically, slow-paying clients disrupt payrolls, bills, investments in machinery and technology, hiring new employees, or even taking new projects. Clients postponing payments according to invoices can cause a lot of trouble to your business and plans.

0 kommentar(er)

0 kommentar(er)